Bitcoin was ranging between $54,000 and $56,000 after Monday’s big drop amid signs market sentiment might be continuing bearish.

The largest cryptocurrency appeared to stabilize after Monday’s 5.8% drop, the biggest single-day decline in almost a month, but some analysts said it would be hard to rule out a fresh turn downward.

“The market is not as confident anymore,” the Norwegian blockchain analytics firm Arcane Research wrote in its weekly newsletter on Tuesday. “More traders are positioned short.”

Read more: Bitcoin Transfer Worth $806M Might Reveal Big Institutional Purchase

Bitcoin, which doubled in price this year to an all-time high above $61,000 earlier this month, has failed several times to push ever higher.

One blockchain data point known as “reserve risk” offers hints as to where bitcoin is in its market cycle. It’s a picture of an asset price that has room to run before making a final push to a new market top. But that leg up might not be far away.

The reserve risk, a metric was created by the blockchain data firm Glassnode, used to assess the confidence of long-term holders relative to the price of bitcoin. Currently, it sits at about 0.008, far below the peak zone of the three past bull markets.

The market previously topped when the reserve risk went above 0.02, shown in the red zone in the chart below:

Jean-Baptiste Pavageau, partner at digital asset management firm ExoAlpha, said Monday’s correction may have partly been caused by traders squaring positions ahead of a major options-market expiration date expected on Friday. Once that’s out of the way, some short-term selling pressure might abate.

Data from Bybt shows that bitcoin options strike prices are clustered between $40,000 and $52,000. Many of those contracts are likely so far out of the money that an unwinding of positions ahead of the expiration looks unlikely.

Pavageau sees bitcoin prices consolidating in the $50,000 to $60,000 range after leaving behind a support level around $45,0000.

Bitcoin’s “overall upward trend” remains “intact,” he said.

Read more: Grayscale’s Sonnenshein Addresses GBTC’s Collapsing Premium

Rishi Ramchandani, director of business development at crypto lending platform BlockFi, noted that trading volumes have been “quieter” during the market’s latest move down.

Ramchandani says prices are likely to “hover around $55,000 to $60,000 unless we see a news catalyst.”

Ether underperforms but Theta moves

Ether (ETH) was down on Tuesday, trading around $1,707.95 and slipping 2.21% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

The No. 2 cryptocurrency moved in tandem with bitcoin. However, there was bullish market action from at least one altcoin, theta token.

Theta token (THETA), the native token for the Theta Network, a blockchain protocol designed to improve streaming video content, saw a significant price gain and was logging new all-time highs on Tuesday, according to data from Messari.

Read more: Ripple Touts Role for XRP in Central Bank Digital Currency White Paper

The price boost of THETA could partly be attributed to major network upgrades scheduled in April, according to Robbie Liu, market analyst at OKEx Insights. The protocol also recently announced that global music giant Sony’s European subsidiary has become a node runner on the Theta network.

At press time, THETA is changing hands at $13.94, up 34.90% in the past 24 hours, per Messari data. It’s up 586.11% year to date, for a market capitalization of $13.22 billion.

Other markets

Digital assets on the CoinDesk 20 are mostly lower Tuesday. The notable winner as of 20:00 UTC (4:00 p.m. ET):

- ethereum classic (ETC) + 1.94%

Notable losers:

- orchid (OXT) – 10.54%

- kyber network (KNC) – 8.22%

- chainlink (LINK) – 4.38%

- cosmos (ATOM) – 3.84%

Equities:

- Asia’s Nikkei 225 closed 0.61% lower.

- The FTSE 100 in Europe closed in the red 0.40%.

- The S&P 500 in the United States also dropped, down by 0.76%.

Commodities:

- Oil was down 6.51%. Price per barrel of West Texas Intermediate crude: $57.55.

- Gold was in the red 0.63% and at $1727.77 as of press time.

Treasurys:

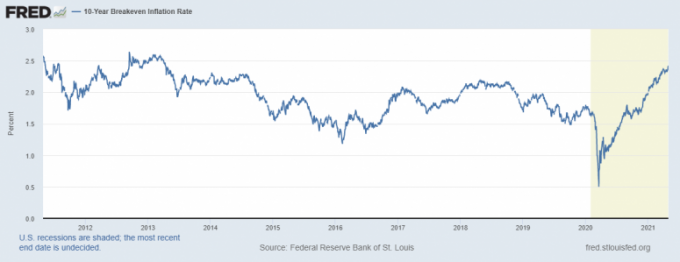

- The 10-year U.S. Treasury bond yield fell Tuesday dipping to 1.630%.