The crypto sell-off over the past quarter was triggered by regulatory crackdowns, concerns about tighter monetary policy, environmental issues and a slowdown in institutional demand. Selling stabilized in June, leaving bitcoin in a tight range of between $30,000 and $40,000.

Bitcoin was trading at around $34,000 at press time and is down about 4% over the past 24 hours.

“Price swings reinforce the idea that volatility is a fundamental part of a nascent and expanding market,” Steve Elrich, CEO of crypto exchange Voyager Digital, wrote in an email to CoinDesk. “Investors are still buying the dip.”

Latest prices

Cryptocurrencies:

- Bitcoin (BTC) $34962.8, -3.92%

- Ether (ETH) $2274.5, +2.31%

Traditional markets:

- S&P 500: 4300.4, +0.2%

- Gold: $1769.5, +0.5%

- 10-year Treasury yield closed at 1.458%, compared with 1.473% on Tuesday

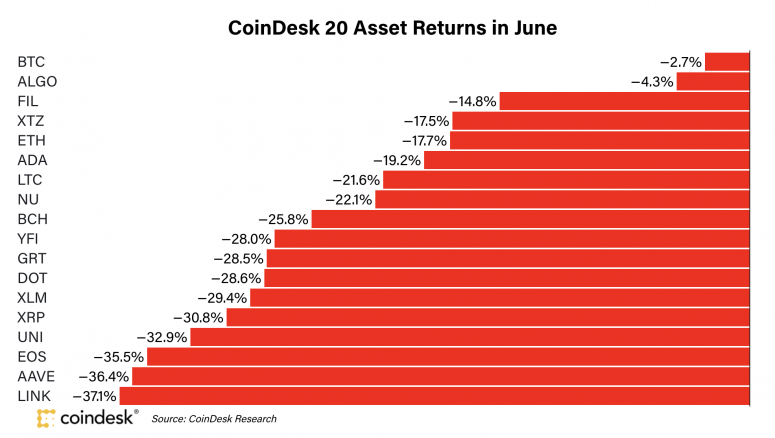

Relative performance in June

Bitcoin outperformed other large market-cap cryptocurrencies in June with a decline of 2.7%, versus declines of more than 30% in XRP, EOS and LINK.

The decline in altcoins stabilized bitcoin’s dominance ratio, or relative market share, at around 45%. There are signs, however, that altcoin demand has risen in recent weeks.

“While bitcoin remains in our top weekly net buys, we are seeing other altcoins gaining popularity in the wake of its dip, including SHIB and ETH which took the top two spots for the week,” Elrich wrote.

Bitcoin and ether volatility remains elevated, albeit lower than January 2020 highs. While both cryptocurrencies have experienced extreme volatile swings over the past year, traditional markets have remained relatively calm.

Bitcoin options probability

The bitcoin options market sees a 65% chance of price remaining above $20,000 by the end of the year. And there is a 20% chance that bitcoin will return above $50,000 according to options data provider Skew.

Bitcoin technicals are also improving as signs of downside exhaustion appeared on the charts last week, according to DeMark Indicators. That suggests buyers could remain active above $30,000 support over the intermediate term.

Lower returns following ‘death cross’

Bitcoin registered a “death cross” when the 50-day moving average crossed below the 200-day moving average on June 19. Typically, a death cross signals a shift from a bullish to bearish trend and occurs after an initial price sell-off.

Returns following a death cross event can vary and tend to be low to negative. “We conclude that [the death cross] is not a consistent downside price predictor over 1, 3, 6 and 12 month periods,” tweeted CoinShares on June 22.

Bitcoin hashrate stabilizes

The Bitcoin hashrate has stabilized after falling for 10 straight days, and industry experts are speculating that the worst fallout from China’s recent mining crackdown might be over.

Bitcoin’s seven-day average hashrate stood at 90.6 exahashes per second on Tuesday, up slightly from 90.5 EH/s on Monday. The number is still down by roughly half from the peak rate reached in mid-May, according to data from Glassnode.

The majority of the reduction stemmed from China’s move to shut down cryptocurrency mining operations in the country, with a little bit from Iran, according to Sam Doctor, chief strategy officer at BitOoda, a digital asset financial services platform.

“We believe there isn’t much active hashrate left in China,” Doctor said in an email to CoinDesk.

Altcoin roundup

- Ethererum mining: The balances of Ethereum 2.0 validators range wildly from 30 ETH to 65 ETH. The main reason for the extreme disparity is not because some validators are more profitable than others or because some validators started earning rewards on the network earlier than others. Roughly 168 validators out of 178,000 simply deposited their minimum stake of 32 ETH twice, by accident, CoinDesk’s Christine Kim explained.

- USDC expansion: USDC, the stablecoin now native to four blockchains, could soon be on eight to 10 more networks, CoinDesk has learned. That would be the broadest expansion of the $25 billion stablecoin to date, potentially surpassing the eight blockchains that support Tether’s USDT, the market leader with a $63 billion market cap.

Relevant news

- Katy Perry Launches NFTs, Acquires Stake in Theta Labs

- There’s a ‘Clearance Sale’ on Bitcoin, but Institutions Aren’t Rushing In

- Hut 8 Buys $44M Worth of Mining Machines to Double Its Hashrate

Other Markets

Most digital assets on the CoinDesk 20 ended up lower on Wednesday.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

cardano (ADA) +0.26%

Notable losers:

xrp (XRP) -5.35%

yearn finance (YFI) -4.43%

eos (EOS) -4.34%