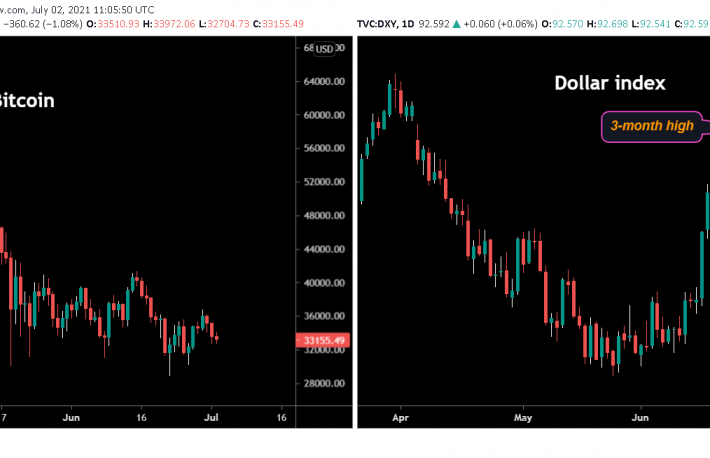

The leading cryptocurrency is changing hands near $33,000 at press time – down 1% on the day – having faced rejection above $36,000 earlier this week. The retreat has poured cold water over the optimism generated by the last week’s rebound from $28,800 to $35,000.

The dollar index, which tracks the greenback’s value against major currencies, clocked a three-month high of 92.60 shortly before press time.

The index has been rising ever since June 16, when the Fed unexpectedly brought forward the timing of the first interest-rate hike to 2023 and has rallied 100 pips this week alone, TradingView data shows.

According to the London-based FX and spread-betting provider City Index, the DXY’s recent rise hints at a strong payrolls figure.

The payrolls data scheduled for release at 12:30 UTC (8:30 a.m. ET) on Friday is expected to show the U.S. economy added 700,000 jobs in June, up from 559,000 in May. The unemployment rate is seen falling to 5.7% from 5.8%, while wage growth may have decelerated, according to FXStreet.

A higher-than-expected number would validate the Fed’s recent hawkish turn, possibly bringing more pain for bitcoin and other asset prices in general.

Fed tightening, that is, higher interest rates or unwinding of liquidity-boosting asset purchases, makes the dollar more attractive and dilutes the appeal of inflation hedges like gold and bitcoin. As such, fears of Fed taper or gradual unwinding of stimulus tend to weigh on bitcoin and other risk assets. Equally, the cryptocurrency could pick up a strong bid if the payrolls data falls short of estimates by a big margin, squashing Fed taper fears.

For example, bitcoin fell sharply to $30,000 in May after the U.S. reported a big rise in inflation, forcing investors to consider the possibility of the central bank closing the liquidity tap sooner than expected.

Before that, the cryptocurrency was on a solid upward trajectory, rallying from $10,000 to over $60,000 in seven months to April, mainly on the back of the central bank stimulus. The Fed began pumping unprecedented amounts of liquidity into the system in March 2020 to help the economy and markets absorb the shocks arising from the coronavirus pandemic.

Also read: Bitcoin’s Sliding Put-Call Ratio Points to Weakening Bearish Sentiment: Analysts

The price action observed over the past 12 months tells us that bitcoin’s fortunes are closely tied to the central bank’s money printing.

Crypto market indicators are painting a mixed picture ahead of the event. While the sliding put-call open interest ratio is giving bullish hints, the low active user participation on the blockchain is signaling weak demand.