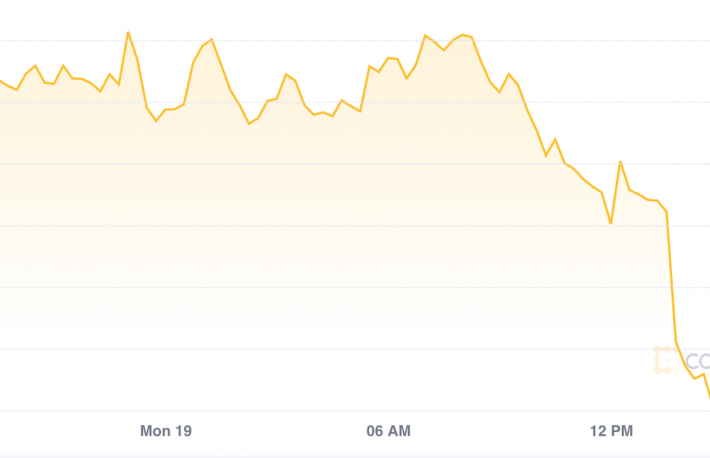

The cryptocurrency was trading around $29,998 at press time and is down about 5% over the past week.

Bitcoin has been locked in the broad price range of $30,000 to $40,000 since mid-May, and briefly broke below the $30,000 mark on June 22. The cryptocurrency fleetingly traded at $29,700 a day after the People’s Bank of China ordered the country’s major financial institutions to stop facilitating crypto transactions.

“I am expecting a strong dip towards $22K,” said Patrick Heusser, head of trading at Crypto Finance AG, in a telegram interview on Monday.

Wall Street is seeing “too much froth” and current virus jitters are triggering widespread panic selling of every top performing asset, with bitcoin (BTC, -5.03%) being right at the top of this list, according to Edward Moya, senior market analyst at Oanda.

Moya said that bitcoin could be vulnerable to a flash crash towards the $20,000 level which “should attract many institutional buyers that have been waiting patiently on the sidelines,”

“If the stock market selloff intensifies, bitcoin and Ethereum will easily extend their declines,” said Moya.

Katie Stockton, founder and managing partner of Fairlead Strategies, said that the consolidation phase bitcoin is currently experiencing is “neutral.”

But in her view, she said, “a breakout is more likely than a breakdown.”

In April, the bitcoin network was “so vibrant, it wasn’t difficult supporting prices above $50K,” said Charles Morris, founder of ByteTree Asset Management.

However, in recent weeks, Morris said, the level of network activity has collapsed.

“Now it is more in keeping with a $15K bitcoin price than a $50K,” he said.

Bitcoin peaked just below $65,000 in mid-April.