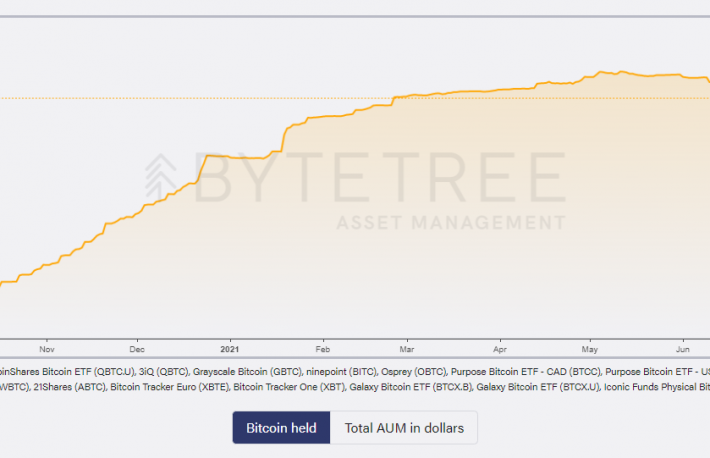

- Data tracked by ByteTree Asset Management shows the number of coins held by the U.S. and Canadian closed-ended funds and Canadian and European exchange-traded funds (ETFs) fell to 782,558 BTC (-3.67%) (worth $28.72 billion) on Friday, the lowest since Feb. 25.

- Holdings have declined by over 15,000 in the past three days alone.

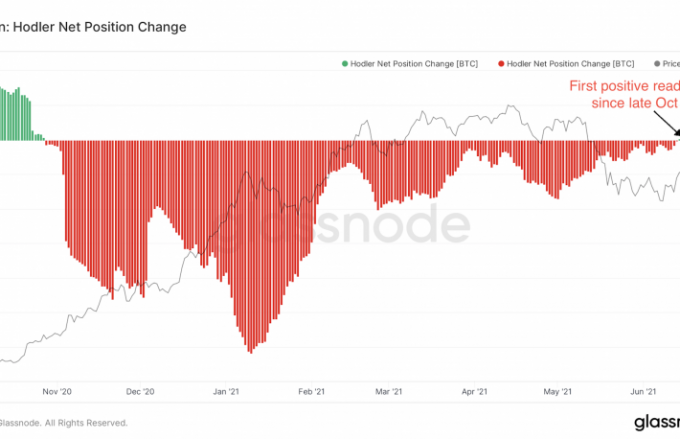

- On Wednesday, the Federal Reserve surprised markets with a hawkish turn, bringing forward the timing of its next interest rate hike to 2023.

- Since then, most assets, including bitcoin, have faced selling pressure, although the leading cryptocurrency has remained relatively resilient compared to most fiat currencies and gold.

- Fund holdings peaked above 815,000 BTC in mid-May, having risen by over 300,000 BTC since October.

- The May peak coincided with the bitcoin’s drop from $58,000 to nearly $30,000.

- BTC held by ETFs and funds are a significant and measurable sample of network demand, ByteTree CIO Charlie Morris told CoinDesk. Heavy institutional buying last October led to a price surge which cooled in the second quarter this year.

Also read: Bitcoin Remains Relatively Resilient Post-Fed as Fiat Currencies Drop Against Dollar