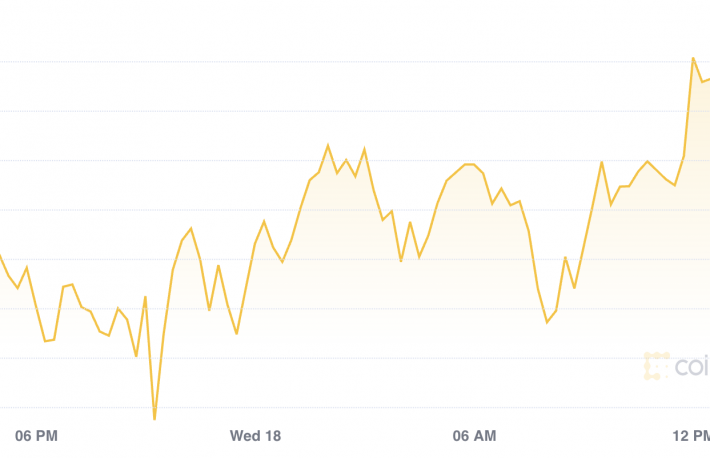

Bitcoin, the world’s largest cryptocurrency by market cap, was trading at around $45,400 at press time and is up 55% year to date, compared with a 19% return for the S&P 500 and a 30% return in commodities over the same period.

Latest prices

Cryptocurrencies:

- Bitcoin (BTC) $44,888, -0.98%

- Ether (ETH) $3026.5, -2.31%

Traditional markets:

- S&P 500: 4400.3, -1.07%

- Gold: $1785.3, -0.03%

- 10-year Treasury yield closed at 1.272%, compared with 1.262% on Tuesday

Analysts are also watching institutional flows throughout the crypto market. A review of regulatory documents reveals that a parade of megabanks, including Goldman Sachs, JPMorgan, Citigroup and Bank of America, and even states such as Tennessee, have told securities regulators they held Coinbase stock (NASDAQ: COIN) on June 30, reports CoinDesk’s Danny Nelson.

But not all investors are dedicated to their crypto holdings. Cathie Wood’s ARK Invest continued to reduce its holdings of COIN and the Grayscale Investment Trust (GBTC) in the past week, according to Chainchatter and Wu Blockchain. Wood is a noted crypto investor. Grayscale is owned by Digital Currency Group, CoinDesk’s parent company.

Crypto could attract a wall of institutional money, says LMAX CEO

Large institutions are warming up to cryptocurrencies and will demand more robust trading infrastructure. “There is a wall of institutional money, and we could see exciting new entrants into the custodian, credit intermediation, and aggregation space,” David Mercer, CEO of LMAX Group, a global institutional exchange, said in an interview.

“Forty percent of our digital-asset clients also trade FX (foreign exchange) and 34 of the world’s biggest banks connect with us,” Mercer said.

LMAX Digital is an institutional cryptocurrency exchange operated by LMAX Group.

Mercer stated that some institutional clients have increased their exposure to crypto from a minority holding to a majority holding. And although altcoins are popular, Mercer does not see ether taking over bitcoin in the near-term.

Institutions face risks with crypto that are different from traditional foreign exchange markets, according to Mercer. For example, “capturing differences in spot prices is very capital intensive and institutions are trading with a lot of unknown counterparties, including exchanges,” Mercer said.

The reliability of technology, depth of liquidity and execution are some important factors that institutions consider when selecting a trading venue, according to a LMAX Digital survey.

In general, Mercer is bullish on cryptocurrencies and expects the total market cap to increase by $5 trillion within the next two years with major financial institutions paying more attention to the field. The total market cap of cryptocurrencies stands at $1.93 trillion, according to CoinMarketCap.

“For me it’s a no-brainer that that amount of money will enter the crypto space, and is looking for a home, and looking for assets to invest in. When one bulge-bracket bank starts trading actively for their clients, the others will follow,” Mercer said.

Crypto adoption shifts to emerging markets

Crypto adoption has increased 23-fold globally over the past year with India, Pakistan, Ukraine and other emerging markets driving the surge, Chainalysis said in a report Wednesday, as CoinDesk’s Muyao Shen reports.

In its “2021 Global Crypto Adoption Index,” Chainalysis found that Chinese and U.S. positions as crypto adoption leaders have been waning amid the Chinese crackdown on crypto trading and the growing role of major financial institutions in crypto markets.

The annual study underscores that crypto adoption is accelerating quickly worldwide and that its use is shifting to markets that not long ago were more moderately active on the crypto front. Meanwhile, those markets that were previously at the forefront are confronting big changes with regulations and financial services.

Instead of measuring crypto trading volume, which favors countries with high levels of professional and institutional adoption, Chainalysis focused on blockchain activity by non-professional and individual crypto users. That methodology encompasses crypto adoption in more ordinary activities, including savings, rather than just trading and speculation.

Bitcoin dominance decline

The market dominance of bitcoin, or the largest cryptocurrency’s value as a share of the overall market, declined to 44% over the past week. The relative market cap loss occurred as altcoins such as ether and cardano outperformed bitcoin during the recent crypto rally.

“Despite bitcoin and ether’s excellent performance this year, neither asset is anywhere close to cardano’s return,” Alexandra Clark, a sales trader at U.K.-based digital asset broker GlobalBlock, wrote in an email to CoinDesk. Cardano is up about 65% month to date, compared with a 21% rise in ETH and a 14% rise in BTC over the same period.

Clark sees future potential for cardano driven by network upgrades.

“Cardano’s Alonzo mainnet hard fork, which is scheduled for Sept. 12 and is one of the most anticipated events in the crypto calendar, will help cardano compete on equal terms with Ethereum,” Clark wrote. “Cardano will tackle one of the asset’s biggest deficiencies by allowing users to run smart contracts on the network.”

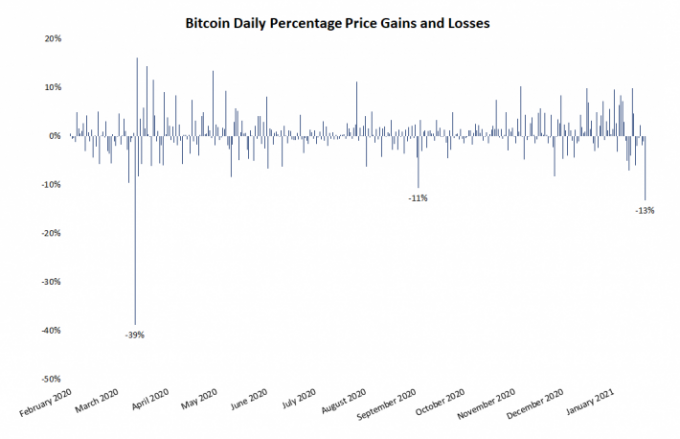

Slowdown in money supply

The slowdown in global money supply could weigh on bitcoin, according to Stifel, a global investment bank. Global central banks are preparing to tighten policy as unprecedented amounts of fiscal and monetary stimulus is absorbed in the economy. And with some asset prices running high, analysts at Stifel expect a repricing of speculative markets such as cryptocurrencies.

On Wednesday, minutes from the July Federal Open Market Committee (FOMC) meeting showed most Fed officials expected to scale down easy money policies this year.

Altcoin roundup

- Avalanche’s AVAX Token Jumps: Avalanche’s AVAX token surged Wednesday after the blockchain announced plans for a $180 million “liquidity mining incentive program” to scale in decentralized finance, or DeFi. The token was up by 18.8% in the last 24 hours at press time, trading at $26.9. The price has more than doubled in the past month, according to data from Messari. The Avalanche Foundation said in a press release the DeFi incentive program titled “Avalanche Rush” will bring top DeFi applications to the platform, including Aave and Curve.

- White hats defused a potential $350M heist on SushiSwap: A group of people in the crypto community, led by crypto investment firm Paradigm’s research partner, Sam Sun, may have just prevented SushiSwap’s token fundraising platform Miso from losing more than $350 million worth of ether after the group discovered and fixed a bug on the platform in less than five hours. Because of the collective efforts, SushiSwap says no funds have been lost. According to a post published by SushiSwap on Monday, Sun and his colleagues Georgios Konstantopoulos and Daniel Robinson – all from San Francisco-based crypto investment firm Paradigm – reached out to the team at Sushi to alert them to “a vulnerability” on the “Dutch auction” contract on the Miso platform.

- Rally submits plan to decentralize itself: Social token startup Rally has submitted a proposal to decentralize itself into an array of entities – some corporate, other community controlled – that would independently build out the Rally ecosystem. The road map would see the crypto-based “creator coin” platform split up into a venture studio, an Asia-based outpost, a Swiss nonprofit, a decentralized autonomous organization (DAO) and a Delaware-based corporation that would carry the Rally name.

Relevant news:

- Bitcoin Lightning Network Growth Passes New Milestones

- Evolve Funds Files for Crypto ETF in Canada

- Crypto Asset-Management Market Will Exceed $9B by 2030: Study

- Bitcoin Mixing CEO Harmon Pleads Guilty to US Money-Laundering Charge

- Minneapolis Fed President Kashkari on Crypto Market: ‘Thousands of Garbage Coins’

- Facebook: Novi Digital Wallet Is ‘Ready to Come to Market’

Other markets

Most digital assets on CoinDesk 20 ended up lower on Wednesday.

Notable winners of 21:00 UTC (4:00 p.m. ET):

cardano (ADA) +2.78%

Notable losers:

filecoin (FIL) -8%

aave (AAVE) -7.79%

uniswap (UNI) -7.7%