“Bitcoin does look fragile,” Lennard Neo, head of research for Stack Funds, wrote in an investor update. “Unless we see a clear break into the positive region, it is difficult to assume the speculative bulls are back.”

Latest prices

Cryptocurrencies:

- Bitcoin (BTC (-3.57%)) $31631.9, -3.48%

- Ether (ETH (-3.94%)) $1923.5, -3.03%

Traditional markets:

- S&P 500: 4360, -0.33%

- Gold: $1828.4, +0.08%

- 10-year Treasury yield closed at 1.303%, compared with 1.34% on Wednesday

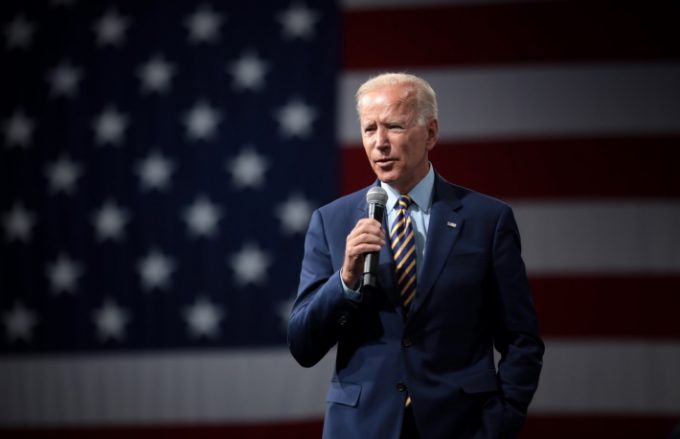

Federal Reserve Chairman Jerome Powell, testifying before the U.S. Senate, weighed in on two areas dear to cryptocurrency traders – the prospect for outsize inflation as the economy reopens and the possible, eventual rollout of a digital dollar.

Powell said he was surprised at how quickly inflation had ticked up. A report earlier this week showed that U.S. consumer prices rose at their fastest pace in 13 years. Federal Reserve officials have characterized the uptick as “transitory,” a rationale for maintaining low interest rates and monthly purchases of $120 billion in Treasury or mortgage securities without fears of runaway prices.

It’s a crucial matter for bitcoin traders who have bet either that the cryptocurrency will hold its value as the dollar’s purchasing power weakens or that it would face selling pressure as a risky asset if the Fed moves to rein in its monetary stimulus.

“We’re experiencing a big uptick in inflation, bigger than, than many expected, bigger certainly than I expected,” Powell said. “And we’re trying to understand whether it’s something that will pass through fairly quickly, or whether we’re in fact, we need to act one way or the other.”

Separately, Powell said he was undecided on whether the benefits of central bank digital currencies outweigh the costs. “The more direct route” would be to regulate stablecoins, Powell said, as reported by CoinDesk’s Nate DiCamillo. “Our obligation is to explore both the technology and the policy issues over the next couple of years, so that we’re in a position to make an informed recommendation.”

The remarks came a day after Powell testified before the U.S. House of Representatives that “you wouldn’t need stablecoins, you wouldn’t need cryptocurrencies,” if there were a digital dollar.

Why bitcoin needs to defend $30K

The simplistic days of trading by scanning technical charts and the spot market order book are passé, CoinDesk’s Omkar Godbole reports.

The bitcoin market has matured since the March 2020 crash, and participants can no longer turn a blind eye toward macroeconomic developments and activity in the futures and options market.

That was especially the case on Thursday, when the sentiment against assets deemed to be risky on Wall Street put downward pressure on bitcoin and pushed the cryptocurrency toward the $30,000 support level, which, if breached, could invite more selling pressure from options traders, leading to a quick slide.

With bitcoin locked in the broad range of $30,000 to $40,000 since mid-May, many options traders have been selling puts at the $30,000 strike and selling calls at the $40,000 strike.

But bitcoin is pushing toward the lower end of the range at $30,000. If that level breaks, traders who sold puts at that level may resort to hedging downside risk by shorting bitcoin futures or selling bitcoin on the spot market.

“If support or resistance levels break, traders will need to quickly hedge because prices will move to new levels fast,” Greg Magadini, CEO of Genesis Volatility, said. “The hedging activity from various traders on the same side of the volatility trade also creates a self-reinforcing event.”

Google Searches for ‘Bitcoin Price’ Reach 7-Month Low

Web search data shows the general populace has lost interest in bitcoin, thanks to the usually volatile cryptocurrency going silent in recent weeks, Godbole reports.

Google Trends, a widely used tool to gauge general interest in trending topics, is currently returning a value of 19 for the worldwide search query “bitcoin price” over the past five years.

That’s the lowest reading since December and marks a significant decline from the peak of 86 observed two months ago. Google Trends provides access to a mostly unfiltered sample of actual search requests made to Google and scales their searches on a range of 0 to 100, according to the company.

The cryptocurrency’s two-month-long dull price action of $30,000 to $40,000 seems to have driven away retail interest, which surged earlier this year.

Nodes on Bitcoin’s Lightning Network double in 3 months

The Lightning Network has increased its capacity by 100 bitcoin in just five days, the fastest growth ever, CoinDesk’s Myles Sherman reports.

The network capacity has climbed to record levels above 1,800 BTC locked in, data show.

In April, the network reached a milestone of 10,000 nodes and had just over 45,000 payment channels holding 1,158 BTC. The number of nodes has since more than doubled to 22,781, while the number of channels jumped to 56,103.

For context, it took nearly a year for the number of nodes to double last time from 5,000 to 10,000.

Lightning Network’s development has been slow, steady and cautious – like anything else that promises to be a major step forward for Bitcoin. But as other coins and chains touted “faster, cheaper transactions,” many bitcoiners were becoming increasingly impatient for Lightning to be ready for prime time. Even now it’s not quite there, and developers caution users that it’s still in the early stages of development.

The big picture is that the Bitcoin network by itself is seen as slow, processing up to seven transactions per second. That “throughput” would need to increase by magnitudes in the thousands or even millions in order to host the global economy, mostly because any blocks written above 1 megabyte are invalid on the current Bitcoin mainnet.

“With on-chain fees going up with bitcoin appreciation cycle, it’s becoming an imperative to use Lightning as a low-cost alternative to transfer smaller amounts of bitcoin,” Oleg Mikhalsky, a partner at Fulgur Ventures, a firm that specializes in researching and investing in Lightning-focused projects, told Sherman.

Altcoin roundup

- DeFi Yield Farming Aggregator Suffers Attack: ApeRocket, a decentralized finance (DeFi) yield farming aggregator, has suffered two flash loan attacks costing users $1.26 million. The attacks occurred on ApeRocket’s Binance Smart Chain and its Polygon fork within a few hours of each other on Wednesday, according to a blog announcement.

- Hong Kong Shuts Down Money Laundering Syndicate That Used USTD: Hong Kong customs has crashed a money-laundering syndicate that used stablecoin USDT (-0.03%) to handle a total of HK$1.2 billion ($155 million) illegal funds, and arrested four suspects, according to a report from the South China Morning Post. The suspects opened three e-wallet accounts with a local platform to trade in USDT, while their operations lasted from February 2020 to May this year, according to the report.

Relevant News:

- Crypto Derivatives Exchange Bybit Expands Into Spot Trading

- Italian Regulator Says Binance Is Unauthorized

- J.C. Flowers to Buy 30% of LMAX for $300M

- Bipartisan US Bill Would Define Digital Assets, Emerging Technologies

- Strike’s Jack Mallers on Fixing the Fiat Problem

Other Markets

Most digital assets on CoinDesk 20 ended up lower on Thursday. In fact everything was in the red except for dollar-linked stablecoins.

Notable losers:

chainlink (LINK (-7.15%)) -6.25%

filecoin (FIL (-5.93%)) -5.17%

litecoin (LTC (-4.54%)) -4.72%