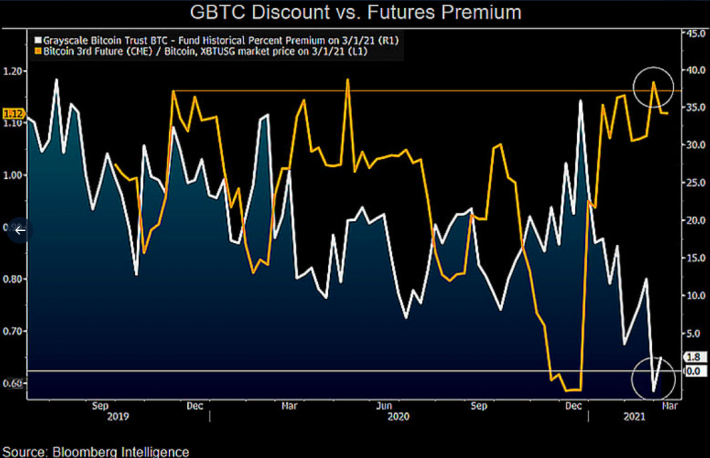

McGlone wrote in a March outlook report that a recent drop below zero in the so-called Grayscale premium – a closely watched metric in cryptocurrency markets – could signal that last week’s swift 21% sell-off to about $43,000 might have reset the market for a fresh run. As of Thursday, prices had rebounded to about $50,000.

The Grayscale premium refers to the difference between price of bitcoin as implied by cost of shares in the publicly-traded Grayscale Bitcoin Trust (GBTC), and the price of bitcoin as traded on cryptocurrency exchanges. Historically, it’s been positive. For a story on the Grayscale premium flipping negative, go here. (Grayscale is a unit of Digital Currency Group, which also owns CoinDesk.)

- Bitcoin’s end-of-February price disparities on U.S. regulated exchanges portend a firming price foundation, if history is a guide, McGlone wrote.

- Indicating capitulation selling, the Grayscale Bitcoin Trust closed at its steepest discount ever, while December CME-traded bitcoin futures settled about 20% higher.

- Normal maturation and increasing market depth will narrow wide price disparities, and we view the end-of-February extremes as an indication of just how nascent bitcoin still is.