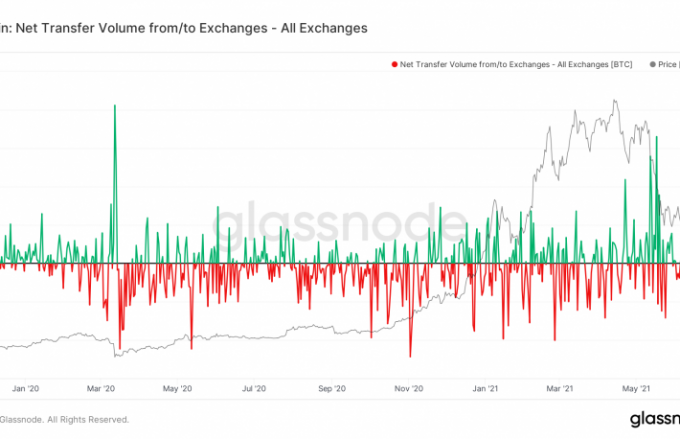

On-chain data shows big money continues to chase bitcoin amid the frantic bull run. That’s a sign of institutions catching the “FOMO” bug, according to one analyst.

Institution-focused Coinbase Pro exchange registered an outflow of over 35,000 bitcoin (BTC, -5.69%) worth more than $1 billion early Saturday, according to data source CryptoQuant.The large outflow comes a day after 12,063 coins left the exchange and represents institutional FOMO (Fear Of Missing Out) buying, according to Ki Young Ju, CEO of the Korea-based blockchain analytics firm CryptoQuant.

Massive outflows from Coinbase Pro usually end in Coinbase’s cold wallets for custody, which is directly integrated with the exchange’s over-the-counter (OTC) desk. Institutions typically transact over-the-counter in a bid to avoid influencing the spot market price, as discussed in December. Bitcoin’s rally from October lows near $10,000 has been mainly fueled by institutional demand. The ascent has gone ballistic over the past four weeks, with prices rising from $19,000 to over $30,000. While Ju’s claim that institutions are now buying on fear of missing out can be challenged, there is evidence that persistent demand from big players is creating a supply squeeze, allowing for a continued price rally.For instance, at least 47,000 bitcoins have left Coinbase Pro in the first two days of the year, while miners have minted just over 1,700 bitcoin. Bitcoin rose from $29,800 to new record highs over $33,000 early today and was last seen changing hands near $31,600.The cryptocurrency is already up 10% this year, having scored a 300% gain last year, according to CoinDesk 20 data.