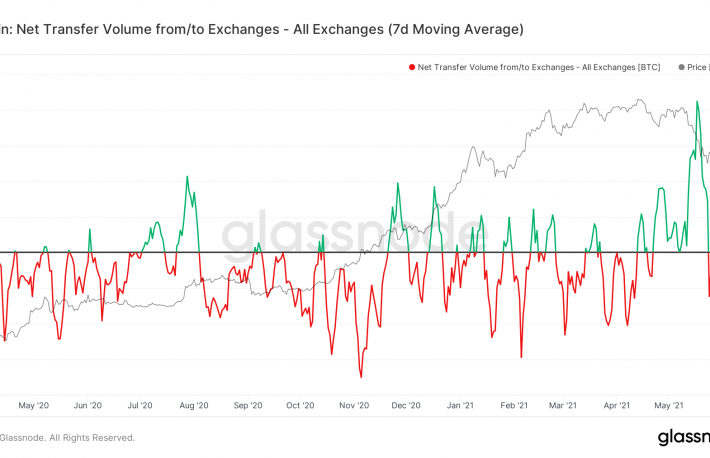

- The seven-day average of net bitcoin inflows to exchanges turned negative for the first time since April 22, data provided by Glassnode show.

- That means coins are leaving exchanges after a gap of four weeks, a sign of investors are starting to take direct custody of their holdings, possibly anticipating a price increase.

- The fewer coins available for sale on exchanges, the better the chance of the market going up.

- Investors typically transfer coins to exchanges when they want to sell their holdings, so consistent net inflows represent a bearish mood, with outflows signalling bullish sentiment.

Also read: Fairlead’s Stockton Plans to Add Bitcoin Exposure Only After Key Indicator Turns Higher