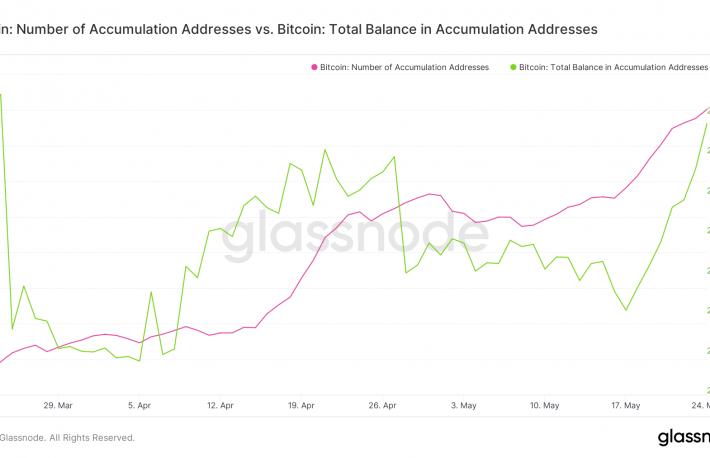

- The count of accumulation addresses climbed to a record for the seventh consecutive day on Monday, taking the total to 545,115, according to Glassnode data.

- The number has increased by 16,445 since May 8 – a sign of persistent bargain hunting by long-term holders during bitcoin’s slide from $58,000 to $30,000.

- The balance held in accumulation addresses has jumped by 30,000 during the same time frame, hitting a two-month high of 2.79 million BTC.

- Glassnode defines accumulation addresses as ones that have at least two incoming non-dust (tiny amounts of bitcoin) transfers and have never spent funds. Essentially, these are long-term holder addresses.

- Over-the-counter (OTC) desks have also seen substantial outflows over the past two weeks, signifying dip-demand from institutional investors.

- On Monday, OTC desks tracked by Glassnode registered an outflow of 11,883, the most since early September.

- However, inflows to OTC desks wallet also spiked to a 5.5-month high of 12,392 on Monday. Inflows indicate an intention to sell but do not imply immediate liquidation.

- Bitcoin is currently trading near $38,000, representing a 2% drop on the day, according to CoinDesk 20.