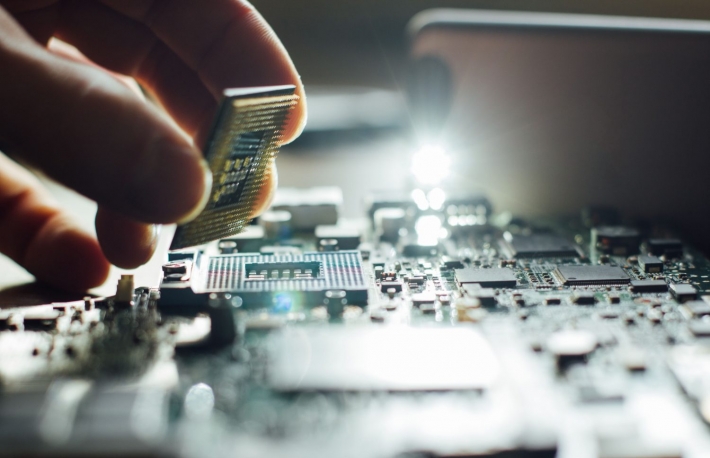

- Sources told Bloomberg the technology company plans for its facility to be capable of manufacturing 3-nanometer chips in the future.

- The exact spend amount could fluctuate, but Samsung is vying to bring back to the U.S. some of the chip fabrication market share that Asian markets currently control.

- This is the news the bitcoin mining industry has been anxiously waiting for; a U.S.-based chip foundry will drastically change the power dynamic between the East and the West, said Nick Hansen, CEO of Seattle-based mining company Luxor Technology, in a direct message with CoinDesk.

- In the future, this could have positive effects for supply chain strains suffered by bitcoin mining machine manufacturers that routinely struggle to obtain a steady and sufficient quantity of chips from foundries.

- Currently, accessing consistent supply of mining machines is a huge bottleneck for industry growth. This will uproot a long-held duopoly in China that has broad-reaching implications, Hansen said.

- But bitcoin miners face incredibly strong competition for these chips from technology giants including Apple and Nvidia, making them a much lower priority customer for most foundries.

- Amid a surge in bitcoin’s price and interesting in mining, demand for new mining ASICs and existing manufacturing constraints have caused leading manufactures like Bitmain to sell out of mining ASICs almost through the end of 2021.

- Bloomberg reported that Samsung plans to invest $116 billion into its foundry and chip design businesses over the next decade in a strong bid to overtake leading manufacturer TSMC.