“I know there is supply available,” said Vincent Vuong, director of sales and procurement at bitcoin mining and hosting company Compass Mining. “I talked to a lot of people. They all have thousands of units but nobody is willing to sell them.”

China’s crackdown on crypto mining sent mining rigs’ prices plummeting a few months ago, but the machines are now trading at a premium thanks to bitcoin’s recent bull run.

In recent weeks, bitcoin has seen some of its largest gains this year, boosting sellers’ confidence in the machines’ prices in the future.

Mining machines manufacturers like Bitmain and MicroBT allow their clients to pre-order the rigs and hold futures contracts for batches of machines that will be delivered on a predetermined future date. This practice has become more common as the coronavirus pandemic has slowed global logistics and created a crunch on the supply chain for materials to make the machines.

The practice has come about also because major chip suppliers such as Taiwan Semiconductor Manufacturing Co. have relatively small quotas for specified chips for bitcoin mining machine makers.

Both futures and spot markets for mining machines have already seen a significant increase in mining machines’ prices, signaling miners’ bullish expectations on the largest cryptocurrency’s price, according to industry pros.

Thus, there has been a dynamic futures contracts market for miners, brokers and speculators, who are making trades based on bitcoin prices and other factors that affect machines’ profitability like electricity costs.

“One of the major bellwethers for bitcoin’s market is the mining machines’ futures market,” said Franky Hu, chief business development officer at MyRig, a miner hosting services provider based in Russia. “When futures contracts of mining rigs are trading at a much higher price than current price, miners are betting on higher bitcoin prices, which leads to a wider profit margin.”

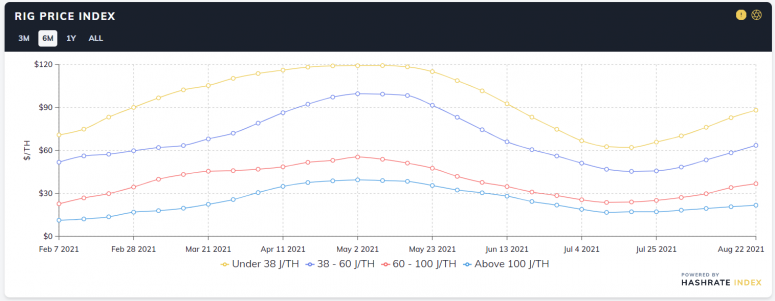

Rig prices across the secondary spot market appear to have bottomed out in July and have risen for three weeks in a row. The prices for different mining machines saw a 7.5% increase on average last week, the biggest jump since the rebound, according to the Rig Price Index by Seattle-based mining company Luxor.

The growth rate of the price of rigs in the secondary market indicates buyers are pricing machines based on a bullish outlook for a bitcoin price that can lead to wider profit margins, Ethan Vera, Luxor’s chief operating officer, said.

The price of the rigs is being set not only by how much the machinery itself is worth, but also by the expected profitability driven by market sentiment regarding the price of the bitcoin those machines could mine.

“Over the past three weeks, the rig prices have outrun bitcoin price; it shows that it is not purely based on current economics, but also future sentiment,” Vera said.

The upside

Early this week, bitcoin recrossed above $50,000 and has been logging gains for five consecutive weeks, which marks its longest weekly winning streak in nine months.

“When bitcoin price goes up, nobody has the incentive to sell their machines,” Vuong said. “There is a lot of upside potential.”

Miners and brokers raked in big profits during bitcoin’s bull runs in the past by making well-timed trades, Vuong said.

For example, the S9, which is one of the older models of mining machines made by Bitmain, was selling for up to $20, before last year’s bull run. However, at the peak of the rally in late 2020, the same machines were selling for $600 to $700, which is 30 to 35 times higher, Vuong said.

Trading mining rigs has become more strategic over time. Vuong even suggested that someone trading hardware might have been able to make more money than actually buying and holding bitcoin itself.

Even in the short-term bearish market, some sellers are opting to wait it out by running their mining machines on a hosting site. Doing so can generate daily profits, which can buy them more time while they wait for the bear market to pass, Vuong said.

What’s more, the sellers are generally able to realize a higher sale price on machines that are already plugged in. “The machine on the shelf is more valuable than those in the warehouse,” he said.

Chinese bitcoin miners calm down

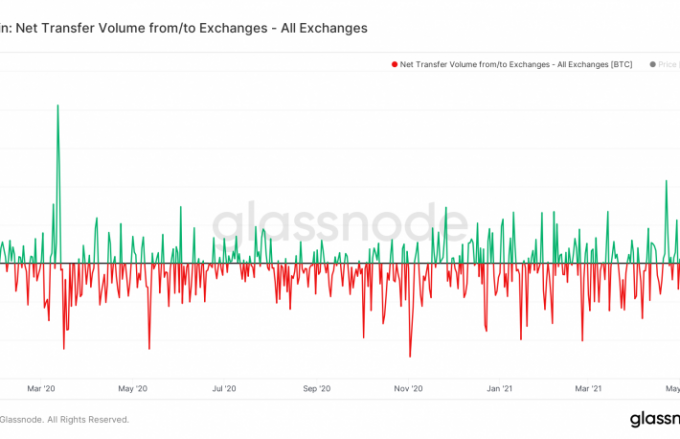

Chinese miners were enthusiastic resellers in the first few months after the ban, resulting in a glut of secondhand machines in the market, according to Vera.

The State Council of China called for a sweeping ban on crypto mining and trading in May, creating a massive market of used mining machines, Vera said.

Some of the large Chinese miners had been running mega mining farms, generating over 1 exahashes per second (EH/s) before the crackdown. After, around one million mining rigs went offline in China, according to Vera’s estimates. Exahashes is a measure of the computational power of a mining machine, which is a heavy-duty computer used to try to solve math problems in order to gain newly minted bitcoin. The computers also process bitcoin transactions.

“The ban forced them to unplug all their machines, which means they could lose millions of dollars everyday,” Vera said.

But now, miners are thinking longer term. “Miners are overall more patient in China, less frantic than they once were when the ban happened,” Vera said.

“They have come to terms with the fact that they are going to lose out on profitability this year and [are spending] more time thinking about how they are going to run their future operations.”

Arbitrage on bitcoin mining rigs

The massive market of used rigs has a price arbitrage mechanism that allows brokers to factor bitcoin’s price into how much a machine might sell for.

At 11 every morning in Beijing, brokers in China update prices for mining machines and relay that information to brokers in North America. That daily update enables miners and brokers in China to factor bitcoin’s price into their rigs’ prices in a matter of hours.

“Whenever the bitcoin price goes up, the machine prices would increase in the next couple of hours,” Vuong said. “No seller would honor the deal with buyers for more than a day unless the two parties have a really good relationship.”

While it could take just a few hours to raise rigs’ prices, it generally takes two to three weeks for them to fall after bitcoin prices drop, giving sellers enough time to adjust their prices.

“Once you saw bitcoin price dropping to around $30,000, it took more than three to four weeks before we started to see the hardware prices start to drop,” Vuong said.

Yet the risk for holding mining rigs still exists because the machines depreciate in value as they tend to deteriorate over time, and miners might lose money sitting on a pile of machines in a warehouse if they cannot find places to operate them.

“Bitcoin mining now requires a lot more strategies,” Vuong said. “There are multiple ways to play it, and it is going to become less about who has the money to spend and more about who has the best future planning and strategy.”

A quiet comeback

Another reason that Chinese miners have stopped selling mining machines is because some of them are able to plug their bitcoin mining rigs back online and mine bitcoins in certain jurisdictions in China, according to two major Chinese bitcoin mining companies that declined to disclose their identities because of China’s laws and regulations on crypto mining.

“Given how much hashrate has come back online and most miners outside China are still building their mining facilities, we think some miners in China with at least a few hundred megawatts of capacity combined have started mining again,” one source said.

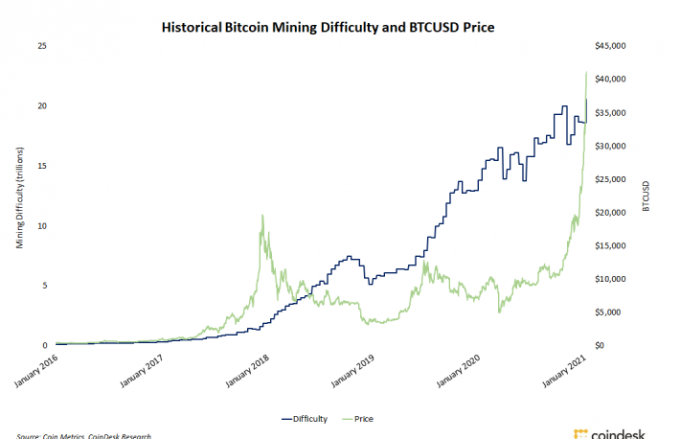

In response to the increase in global hashrate as more miners come back online, bitcoin’s mining difficulty rose by 13% today in the latest biweekly adjustment. This latest adjustment, the largest since July, marks the third consecutive upward adjustment.

On the other hand, another source said some Chinese miners might have to shelve or sell their mining machines after the rainy season in South China comes to an end.

According to the data from Arcane Research, the bitcoin hashrate 14-day moving average has held above 100 EH/s. That is a 25% increase from the lows.

But large public Chinese mining companies migrating out of China such as BIT Mining are not recovering at nearly the same rate, and miners outside China are still building new facilities to add more hashrate.

BIT Mining has been deploying thousands of its mining machines to new facilities in central Asia and North America, but only a few hundred petahashes/per second (PH/s) of the company’s hashrate has been recovered, compared with its theoretical maximum hashrate of 1425.3 PH/s (1.42 EH/s).

Private and small-sized bitcoin miners, on the other hand, are beginning to see a more positive future with China’s regulations on crypto mining.

“Right now, some miners in China think that some hashrate will be plugged back in China, especially with the use of Ethereum GPU (graphics processing unit) mining machines not being banned in the country anymore,” Vera said. “They think that maybe a few hundred megawatts can come back online by the end of this year in China and that has increased the sentiment of Chinese brokers and miners.”

There may be more increases in rigs prices in the long term as new institutional players such as family offices are entering the bitcoin mining industry, according to Hu of MyRig.

From power producers to real estate to family offices, a variety of non-crypto companies are eyeing bitcoin mining to diversify their revenue streams. “Every company is becoming a mining company nowadays,” Hu said.