The report said the downward trading indicates that institutional investors are being “cautious” at the moment. It also notes that three-month futures in bitcoin are in backwardation, meaning they are traded at a discount to current spot prices. That is generally perceived to be a bearish signal.

Open interest on the Chicago Mercantile Exchange (CME) as a share of total bitcoin futures was climbing at the end of May, but is now trading downward. The CME’s open interest is currently sitting at 12.2% of the bitcoin futures market, according to the report. That puts it in fourth place, behind retail platforms Binance (22.5% of total open interest), OKEx (14%) and Bybit (12.9%).

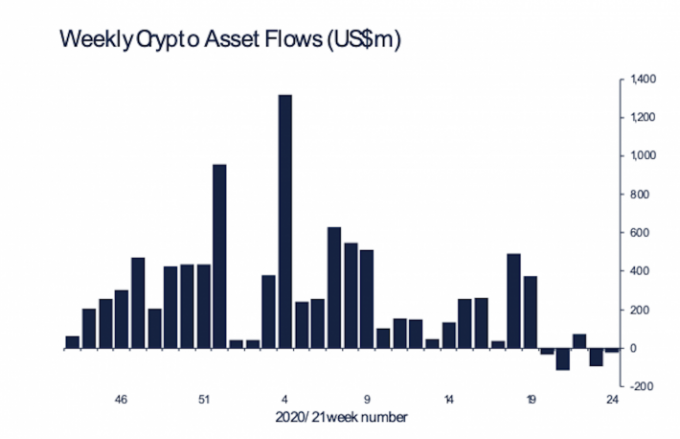

“I think it’s safe to say that institutional interest has waned,” said Nathan Cox, chief investment officer at Two Prime. Cox said that institutions remain “hungry” for crypto as a whole, but their ability to step in is limited by the recent volatility in the market.

Meanwhile, some note the decline in futures activity indicates that other market participants are also stepping back.

“What this shows is a lot of retail traders got burned when the market started to come lower,” said Patrick Heusser, head of trading at Crypto Finance AG.

Nonetheless, Two Prime’s Cox remains optimistic that larger investors will buy the dip.

“As things stabilize I would expect to see large institutions announce positions, likely being accumulated into this pullback,” he said.